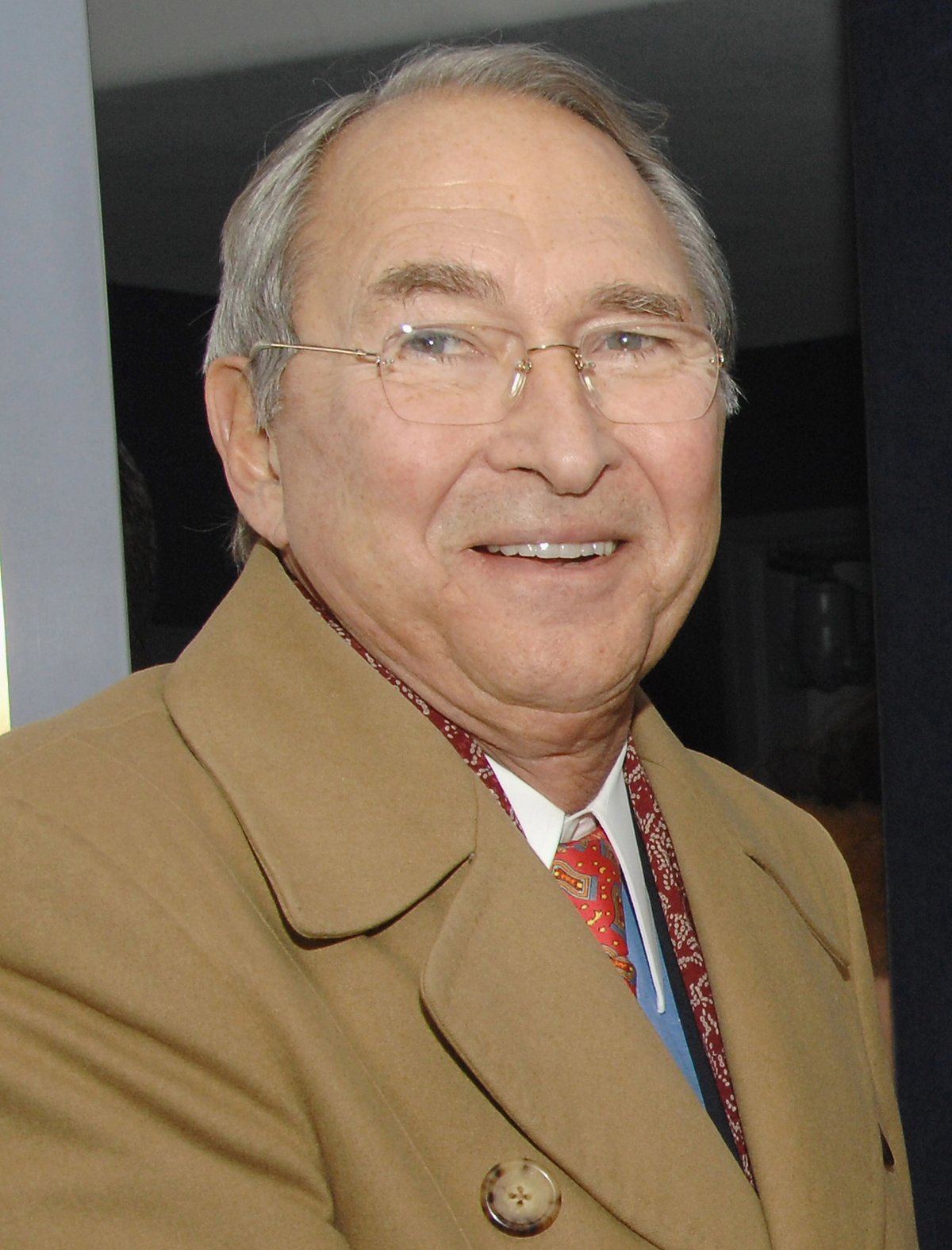

Sheldon Solow, a self-made billionaire real estate developer and major art collector, died in Manhattan on 17 November aged 92. According to Forbes, was worth $4.4bn.

Solow's collection spanned everything from Renaissance art and Egyptian antiquities to African and Modern art. His Botticelli, Portrait of a Young Man holding a Roundell (around 1480) showing a smooth-faced young man, holding a small portrait of a saint painted in the 14th century which had been inserted into the picture, was sent for sale earlier this year and is expected to fetch around $80m at Sotheby’s in late January 2021. So far, it is not protected by a guarantee.

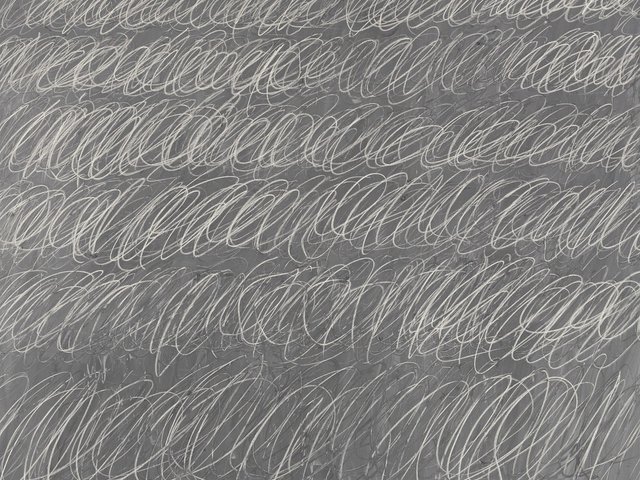

Solow was known for his serial litigiousness, but also for his ardent use of tax advantages, notably through a 501(c)3 private operating foundation, into which he put at least some of his art; tax filings from 2017 put the value of its assets at $215.8m. This was for works such as the Botticelli, in which the foundation had a 99% interest, and which was valued at $60m in 2017, along with a Miró triptych valued at $34.5m and works by Glenn Brown, Matisse, Giacometti and Van Gogh among others. The foundation made donations totalling $36,500 to a New York university ($25,000) and to the Metropolitan Museum of Art ($11,500) in 2017.

Now, according to Artnet, Solow’s widow Mia Fonssagrives-Solow is planning to turn the space into a private museum, accessible to the public, saying that this was her husband’s wish. “It’s something he’s wanted to do all his life, but he didn’t come around to doing it until now,” she told Artnet.

In the US, 501(c)3 organisations—the designation is the tax code—are tax-exempt private foundations which receive their income from investments and endowments, from a single individual or family rather than the public. The tax-exempt status is supposedly justified because the organisation is operated for the public benefit.

According to its 990-PF tax filing, the Solow Art and Architecture Foundation “maintains and displays artwork for exhibition to the public at the 9 West 57th Street New York building.”

Until now, however, the public had no access to the works of art, although some could be glimpsed through glass in the Solow building.

A spoof website, www.solowfoundation.org, lists the “opening hours” as:

Monday: Inaccessible

Tuesday: Closed

Wednesday: No public hours

Thursday: Not open

Friday: Same as the rest of the week

Saturday: None

Sunday: Absolutely not

The spoof site was set up by Ethan Arnheim, a collector based in Washington who would like to see more public scrutiny of these organisations. He had called for further investigation, along the lines of the Hatch report. In 2017 Senator Hatch examined 11 private museums and in a letter sent to the Internal Revenue Service said: “I remain concerned that this area of our tax code is ripe for exploitation.”

The Solow foundation certainly benefited from the US tax code, as the late Solow reportedly paid about $1.3m for the Botticelli in 1982, and donated it—initially partially, then to the level of 99%—to his foundation. Because it is being sold by the foundation, at least $33m will be saved on capital gains tax, since it is tax exempt. And in addition Solow was probably able to deduct the value of any art donated from his personal income tax, since the appraisal is made at the market value of the art at the time of filing the tax declaration, not the initial value.

The sale of art—such as the Botticelli—from the Solow foundation cannot directly benefit his heirs, since the money goes back into the foundation. With a new museum, the foundation will finally be justifying its tax-free status as being in the public interest—and probably save Solow's heirs millions in inheritance taxes.